Tesla boss Elon Musk has handed over the first of what he hopes will be a mass-market electric car to employee buyers, setting the stage for the biggest test yet of the company’s plans to revolutionise the auto industry.

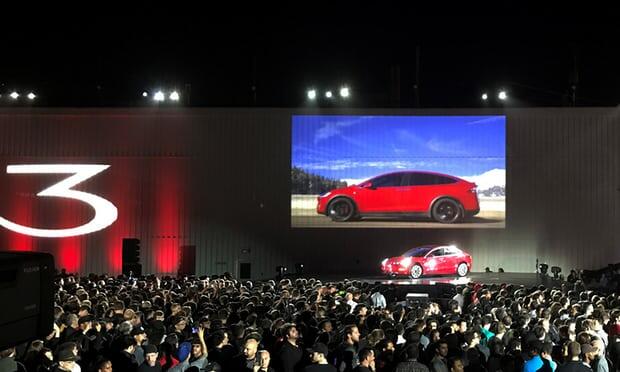

Outside Tesla’s factory in Fremont, California on Friday night, Musk showed off the $35,000 Model 3 which has a range of 220 miles (350 km) on a charge that marks a departure from the company’s earlier luxury electric cars.

Hours before the event, Musk acknowledged it would be “quite a challenge” to build the car during the early days of production.

“We’re going to go through at least six months of manufacturing hell,” Musk told journalists.

The over half a million reservations are up from about 373,000 disclosed in April 2016. Customers pay $1,000 refundable deposits for the car, which is eligible for tax credits. Any new buyers would likely not receive their car until the end of 2018, Musk said.

A longer-range version of the car is priced at $44,000 and will drive 310 miles (500 km) on a single charge. The cars feature a streamlined dashboard devoid of buttons or knobs, with a touchstream display to the right of the driver.

Tesla faces major hurdles living up to the Model 3 hype. The 500,000 vehicles Tesla vows to produce next year are nearly six times its 2016 production.

Were Tesla to produce, and sell 500,000 cars per year, the company would likely outsell the BMW, Mercedes, or Lexus brands in the United States.

Production delays and quality issues marred the launches of Tesla’s Model S and Model X vehicles, and the company blamed production problems for a shortfall during the second quarter of this year. Musk has said a simpler Model 3 design will greatly reduce potential assembly-line problems.

Tesla has burned through more than $2bn in cash so far this year ahead of the launch. A troubled Model 3 launch could heighten the risks for the company, while a steady delivery of Model 3s could generate a stream of cash that would allow Tesla to avoid going again to the capital markets to fund its operations.

Tesla’s share price has surged 54% since January in anticipation of the Model 3 launch, and Tesla’s pricey valuation now exceeds that of traditional rivals like General Motors and Ford .

Until now, Tesla has operated as a niche producer of luxury electric vehicles, with a charismatic, showman chief executive who regularly interacts with fans on his Twitter account. Now loss-making Tesla is trying to move into a different league, building vehicles in high volume for customers able to pay only a few thousand dollars more than the average price of a conventional car or truck sold in the US.

The Model 3 is part of Musk’s broader plan to build a clean energy and transportation company that offers electric semi trucks, rooftop solar energy systems and large-scale battery storage systems.

Source: http://bit.ly/2uLyawo